10

2022

-

06

Research and Analysis on the Market Scale of China's Powder Metallurgy Industry

The downstream application fields of powder metallurgy parts are extensive and are the main driving force for the growth of the market scale. In recent years, with the continuous emergence of new technologies and new processes, the application field of powder metallurgy parts has expanded rapidly, and the automotive industry, machinery manufacturing, electronic appliances and high-tech industries have developed rapidly, providing a strong driving force for the development of powder metallurgy industry. According to statistics from the China Machinery Association Powder Metallurgy Association, in terms of sales revenue, the market size of China's powder metallurgy industry increased from 12.50 billion yuan in 2014 to 14.32 billion yuan in 2018, with a compound annual growth rate of 3.5%, showing a stable growth trend . In the next five years, with the application of powder metallurgy components in emerging fields, such as 5G communication, new energy, etc., the market size of China's powder metallurgy industry is expected to maintain a compound annual growth rate of 5.0% and continue to grow steadily, reaching 18.28 billion in 2023. Yuan.

The industrial chain of China's powder metallurgy industry is divided into three parts: the upstream participants of the industrial chain are the raw material suppliers of iron powder and copper powder, the main players in the midstream of the industrial chain are the manufacturers of powder metallurgy parts, and the downstream applications of the industrial chain are transportation machinery (automobiles, motorcycles, etc.) Vehicles), electrical machinery (home appliances, power tools), industrial machinery (agricultural machinery) and other (construction machinery, other) and other industries.

Upstream analysis

The upstream players in the powder metallurgy industry chain are mainly iron powder and copper powder raw material suppliers.

(1) Iron powder: Iron powder is an indispensable metal raw material in the machinery manufacturing industry. It is used to produce powder metallurgy parts and has physical properties such as fluidity, formability, and particle shape. Powder metallurgy parts made of iron powder are widely used and have good economic benefits. Chinese iron powder manufacturing enterprises have the characteristics of small production scale and low concentration, and there is a gap with developed countries in terms of technical level and equipment technology. Domestic iron powder is mainly general iron powder, which is poor in quality and performance. High-end iron powder Powder such as ultra-pure iron powder, special-purpose iron powder and other products need to be imported.

(2) Copper powder: Among powder metallurgy raw materials, the amount of copper powder is second only to iron powder. It is mainly used to produce powder metallurgy parts, diamond tools, alloy tools, etc., and plays an important role in industrial production. Compared with foreign excellent enterprises, Chinese copper powder manufacturing enterprises have a big gap in scale, production capacity, technical process and product quality. The products are mainly concentrated in low-end fields, and their profitability is limited. High-end copper powder is mostly imported.

Due to the small scale and low technical level of China's powder metallurgy raw material suppliers, their products are mostly used in low-end fields. The raw materials used for high-end powder metallurgy parts are still provided by foreign companies, and high-end products are highly dependent on imports of raw materials.

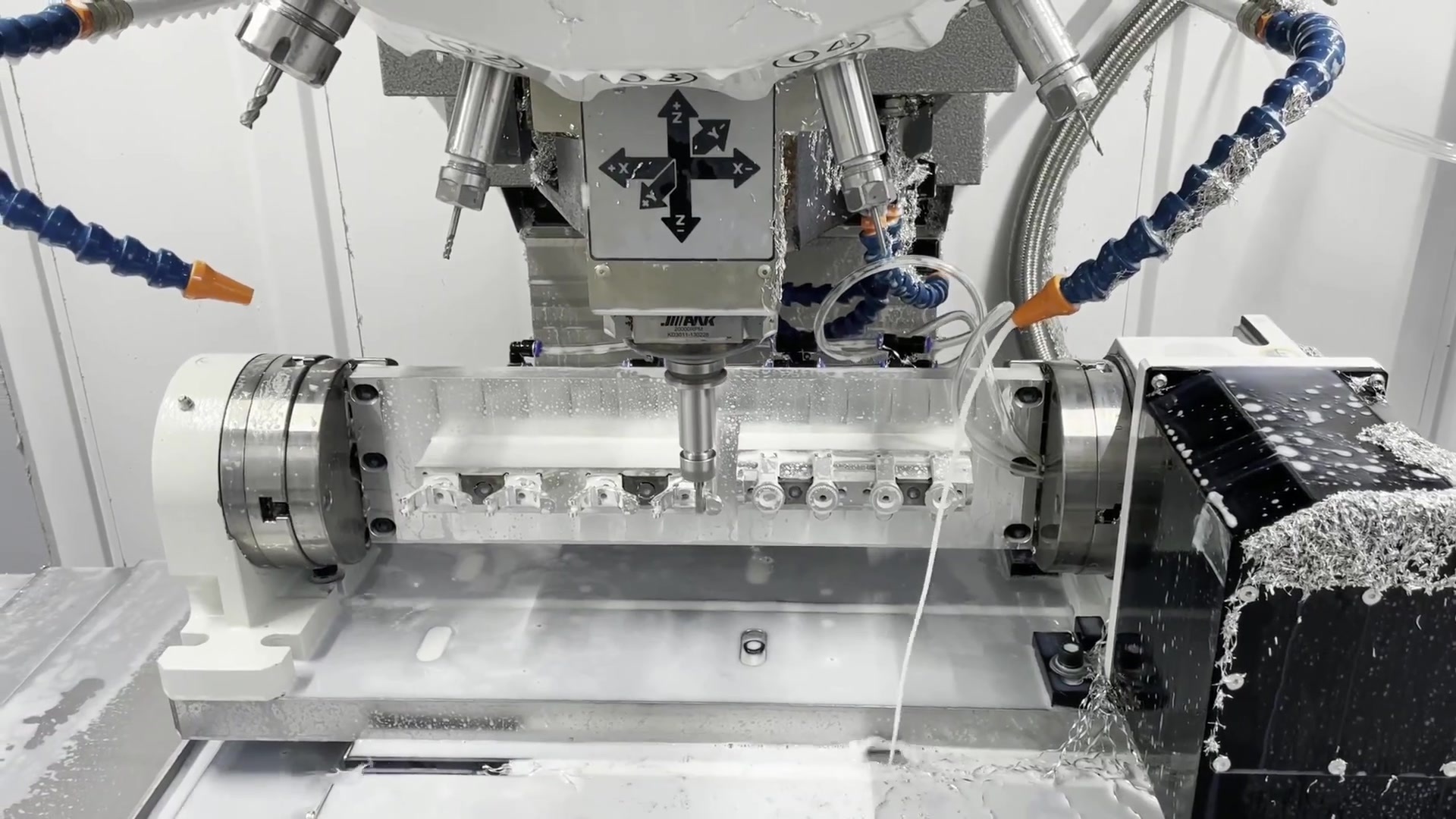

Midstream Analysis

The midstream participants of the powder metallurgy industry chain are mainly powder metallurgy parts manufacturers, most of which are small and medium-sized enterprises, with a low market concentration. Dongmu Co., Ltd. is the largest powder metallurgy manufacturer in China, with comprehensive advantages in technology, scale, and market influence, with a market share of about 25%.

China's powder metallurgy industry presents a market pattern with coexistence of domestic and foreign manufacturers and obvious polarization:

(1) The entry barriers to the low-end powder metallurgy market are low, the product homogeneity is serious, and the market participants are mainly Chinese small and medium-sized enterprises;

(2) The high-end powder metallurgy market has the characteristics of high product quality requirements and high technical barriers, and the supply of products is in short supply. The market participants are mainly foreign advanced enterprises and a few leading Chinese enterprises.

China's powder metallurgy industry has obvious structural overcapacity, fierce competition in the low-end market, and the market tends to be saturated. The competitiveness of enterprises without independent research and development capabilities will gradually decline, and the development space will continue to shrink. The market share of enterprises with advanced technology and high product quality will gradually increase. With the withdrawal of backward enterprises, the concentration of the industry will increase, and the situation of leading enterprises becoming stronger will tend to be stable. In the future, China's powder metallurgy industry will usher in an important period of optimization and development for the optimization and adjustment of industrial structure and the transformation and upgrading of products.

Powder metallurgy manufacturing enterprises with timely updating of supporting equipment, perfect production process and strong technical research and development strength have higher bargaining power in the industrial chain.

Downstream Analysis

Downstream demand is the core driving force for the development of the powder metallurgy industry, and the overall strong downstream demand in China will further increase the size of the powder metallurgy market. The downstream application fields of powder metallurgy industry are mainly transportation machinery, electrical machinery, industrial machinery and other construction machinery. According to the statistics of the China Machinery Association Powder Metallurgy Association, in 2018, in the composition of powder metallurgy parts production, transportation machinery (automobiles, motorcycles) accounted for 59%, and electrical machinery (home appliances, power tools) accounted for 25% , Industrial machinery (agricultural machinery) accounted for 2%, and other (construction machinery, others) accounted for 14%.

The automobile industry is the most important application area of powder metallurgy parts. According to the data of China Association of Automobile Manufacturers, China's automobile production increased from 23.723 million in 2014 to 27.809 million in 2018, with a compound annual growth rate of 4.1%. More than % of the parts must use powder metallurgy parts, so the growth of demand in the automotive industry has greatly accelerated the development of the powder metallurgy industry. Powder metallurgy technology has the characteristics of energy saving, material saving, green environmental protection, and has a strong alternative to traditional processes. With the continuous advancement of technology, the downstream application fields of powder metallurgy will expand to new energy, medical, aerospace and other industries, and the application fields will expand It will bring new development opportunities for the powder metallurgy industry.